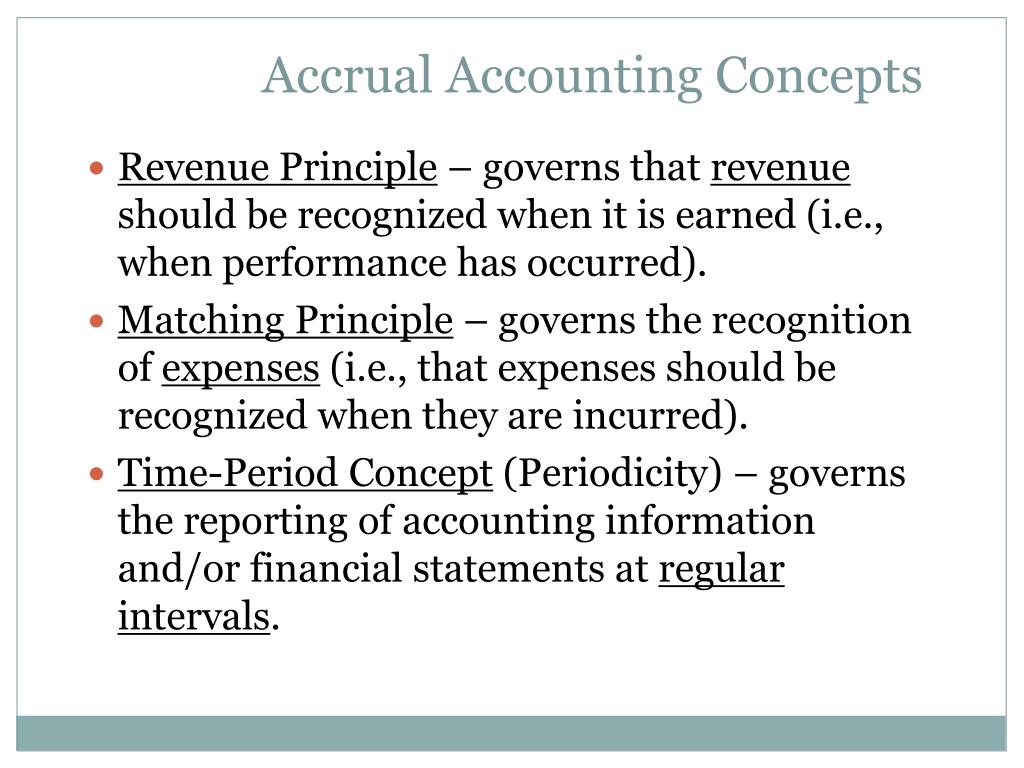

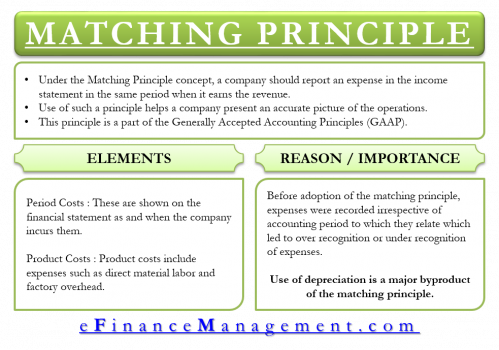

There cannot be a mismatch in reporting expenses and revenues otherwise, financial statements are presented unfairly to stakeholders. The cost is reported in the same period as revenue associated with the sale. When this matching is not possible, then the expenses will be treated as period costs.įor example, when the landscaping company sells the gardening equipment, there are costs associated with that sale, such as the costs of materials purchased or shipping charges. Overall, the “matching” of expenses to revenues projects a more accurate representation of company financials. In this case, it is going to record 1/12 of the annual expense as a monthly period cost. The principle has determined that costs cannot effectively be allocated based on an individual month’s sales instead, it treats the expense as a period cost. For example, assume that a company paid $6,000 in annual real estate taxes. The principle also requires that any expense not directly related to revenues be reported in an appropriate manner. All five steps essentially occurred simultaneously in this example, as would be true with many retail transactions.Īccrual accounting also incorporates the matching principle (otherwise known as the expense recognition principle), which instructs companies to record expenses related to revenue generation in the period in which they are incurred. The landscaping company will recognize revenue $200 immediately, given that they provided the customer with the gardening equipment (product) and thus have completed their performance obligation, even though the customer has not yet paid cash for the product. While this “contract” is not in writing, the company has an unwritten contract to transfer new, unbroken equipment to the customer for the agreed upon price-even if the company is getting the cash in the future. It sells a $200 package of gardening equipment to a customer who pays on credit. Let’s say that the landscaping company also sells gardening equipment. The landscaping company will record one month of revenue ($100) each month as it meets its contractual requirement, or in other words, fulfills its performance obligation, even though the customer has not yet paid cash for the service (step 5). The landscaping company records revenue earnings each month (step 4) as they fulfill their performance obligation, which is providing the landscape service as agreed to with the customer.

ACCRUAL ACCOUNTING MATCHING PRINCIPLE FULL

The customer sets up an in-house credit line with the company, to be paid in full at the end of the six months. Assume the landscaping workload is distributed evenly throughout the six months. For example, a landscaping company signs a $600 contract with a customer (step 1) to provide landscaping services for the next six months (step 2) for a total fee of $600 (step 3). First, it is important to remember that the accrual accounting method aligns with this principle, and it records transactions related to revenue earnings as the performance obligations are met, not when cash is collected. While a detailed look at each of these five requirements is too involved for an introductory course, we can use a simple example to show the five steps. Recognize revenue when each performance obligation is satisfied.Allocate the transaction price to the separate performance obligations.Identify the separate performance obligations in the contract.

Identify the contract with the customers.Revenue can be recognized when all of the following criteria have been met: This may not necessarily be when cash is collected, as will be illustrated in a later example. To know exactly when and how much revenue to recognize, companies follow FASB’s five-step revenue recognition process in which revenue is recognized at the fifth step. This performance obligation is the performance of services or the delivery of goods being carried out in return for an amount of consideration (often cash) the company expects to receive from the customer. The main revenue recognition objective is to recognize revenue after the company’s performance obligation. Do you recognize revenue when the sale occurs or when cash payment is received? When do you recognize the expenses associated with the sale? How are these transactions recognized? Accounting Principles and Assumptions Regulating Revenue Recognition Regardless of credit payment method, your company must decide when to recognize revenue. This means that your store is owed money in the future from either the customer or the credit card company, depending on payment method. Many of your customers choose to pay with a credit card or charge the purchase to their in-house credit accounts.

You own a small clothing store and offer your customers cash, credit card, or in-house credit payment options.

0 kommentar(er)

0 kommentar(er)